80000 deposit how much can i borrow

How much of a deposit can you save. The amount you need to borrow depends on the size of your deposit and the property price.

How Do I Calculate How Much Money Is Available For A 401 K Loan

So you own 40 of the home and 80000 can be used as equity.

. Monthly deposit m 500 Monthly interest rate r 000416666666666667 ie. Some lenders understand this and let you borrow more than 80 of the propertys value. When you have rent bills and groceries to pay for its not easy to save that much.

Lenders generally prefer borrowers that offer a significant deposit. Generally banks and financial institutions will recommend you have a deposit of at least 20 of your prospective propertys purchase price. Deposit checks manage cards and so much more.

If you reside in London your annual household income. Bill may take a loan up to 40000 which is the lesser of 50 of his vested account balance and. Usually 20 of the full value of the house is a good amount to aim for as a deposit.

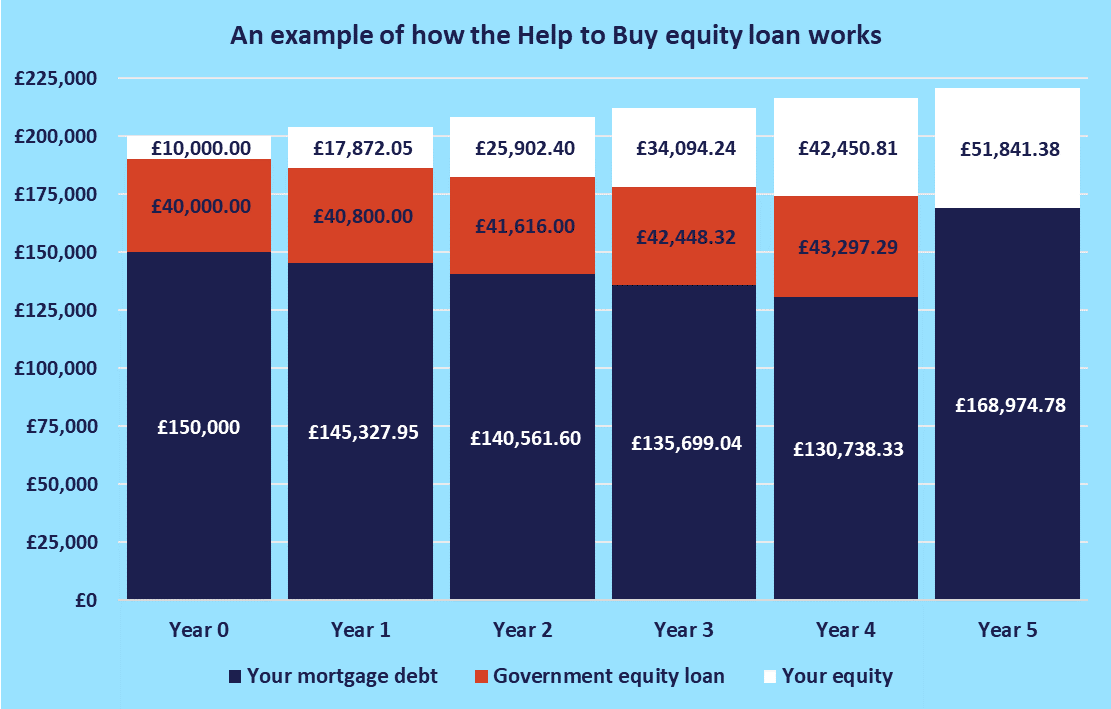

Help is at hand if youre struggling to save up a big enough deposit for your first home. To qualify your annual household income must be 80000 or less outside of London. Plans are not required to include this exception.

Bills vested account balance is 80000. Because LMI allows borrowers to purchase a property with a smaller deposit it can be a real facilitator for investors who want to build a diverse. If a house is valued at 180000 a lender would expect a 9000 deposit.

In such case the participant may borrow up to 10000. The following table highlights current Redmond mortgage rates. Or youre not in a position to cover its costs but you still want to borrow more than 80 of a propertys purchase.

Suppose you borrow 16000. 80000 is a lot of money. So if we go back to our 400000 home youd want to.

An exception to this limit is if 50 of the vested account balance is less than 10000. Up to 30 years. You put down a deposit of 5 the government lends you up to 20 in England and Wales or 40 in London and you get a mortgage to cover the remainder.

It also imposes required incomes limits. Tripple A Manufacturing needs to acquire a piece of equipment which will cost the company 80000. Help to Buy equity loan.

The amount left over after you minus the deposit from the property value gives you the amount you need to borrow. Larger home loan deposit less to borrow. Some will lend you up to 95 meaning your deposit will be 5 plus the associated purchase costs.

The interest rate is 10 and it requires 4 equal end-of-year payments. Home Equity Line of Credit. A 5 deposit means you still have to borrow 95 of the homes value from the lender meaning you have an LVR of 95.

Perhaps a better question to ask is how much should you have for a house deposit Which actually has a more straightforward answer. Government scheme offering discounts of up to 30 for. Of this assigned credit limit of S80000 you may wish to take a loan of S70000 and use the remaining S10000 for personal and retail expenses.

Your options if youre struggling to save. How Much Can You Afford to Borrow. If you have an annual income of S120000 you can apply for a credit limit of up to S80000 S10000 x 8 equivalent to 8 times of your monthly income subject to the banks approval.

And have built up 80000 in savings. Use our ATM Locator to find an Alliant Credit Union ATM or search 80000 fee-free ATMs. They typically request at least 5 deposit based on the value of the property.

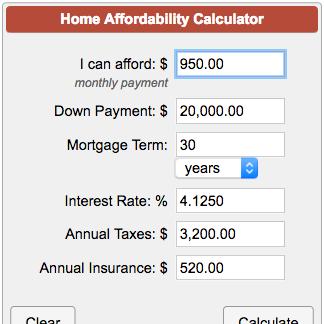

Current Redmond Mortgage Refinance Rates on a 260000 Fixed-rate Mortgage. So if you deposit 25 on a home that would mean the LTV is 75. You can use the above calculator to estimate how much you can borrow based on your salary.

This means that if the property you want. 005 12 Number. In this example the lender would be willing to offer a loan amount of 171000.

Lenders decide how much you can borrow based on whats known as serviceability calculations. By default the table lists refinancing rates though you can click on the Purchase heading to see purchase money mortgages. You can still get a loan if you have a smaller deposit but you may need to take out Lenders Mortgage Insurance.

After factoring in upfront costs youd have around 35000 left for a deposit which.

How Much Can I Borrow With A Va Loan

How Much Can I Get For A Mortgage Cheap Sale 60 Off Www Ingeniovirtual Com

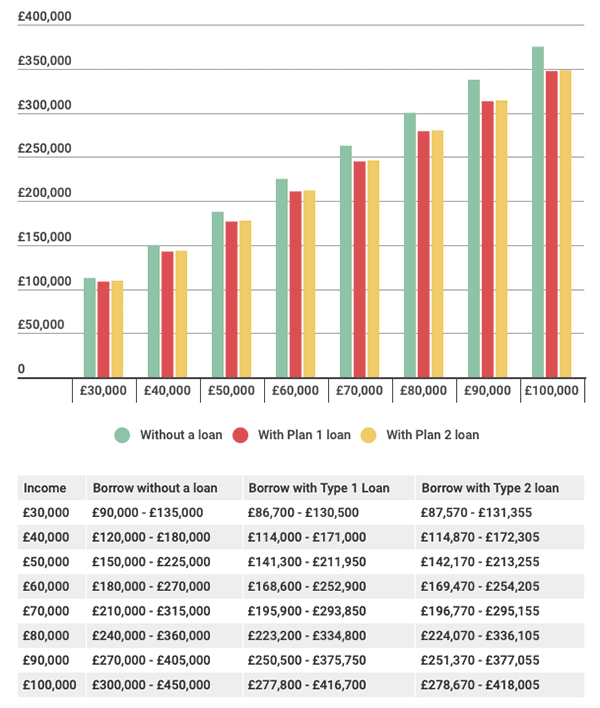

How Much Can I Borrow Depending On My Deposit Mozo

How Much Can I Get For A Mortgage Cheap Sale 60 Off Www Ingeniovirtual Com

How Much Can I Borrow Home Loan Calculator

Ultimate First Time Buyer Guide How Much Money Do You Need To Buy A House

How Much Can I Get For A Mortgage Cheap Sale 60 Off Www Ingeniovirtual Com

How Much Can I Borrow Home Loan Calculator

How Much House Can I Afford Calculator Money

How Much Can I Borrow Depending On My Deposit Mozo

How Much Can I Get For A Mortgage Cheap Sale 60 Off Www Ingeniovirtual Com

How Much Can I Borrow Depending On My Deposit Mozo

How Much Can I Get For A Mortgage Cheap Sale 60 Off Www Ingeniovirtual Com

How Much Can I Borrow Depending On My Deposit Mozo

How Much Can I Borrow On A Mortgage And How Much Can You Really Afford To Borrow Mortgagehq

How Much Deposit Do I Need To Buy A House In The Uk Metro News

How Much Can I Borrow Home Loan Calculator