29+ heloc vs mortgage calculator

Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt. Web 2 days agoMany or all of the offers on this site are from companies from which Insider receives compensation for a full list see hereAdvertising considerations may impact.

845 Williams Rd Defuniak Springs Fl 32433 Zillow

Ad Precise Monthly Payment Calculations.

. This calculator will help you determine whether a home equity. Ad Check Your Reverse Mortgage Eligibility Find Out What Funds You May Qualify for. Ad Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

Web To determine how much you may be able to borrow with a home equity loan divide your mortgages outstanding balance by the current home value. Ad Put Your Home Equity To Work Pay For Big Expenses. Web There are multiple key differences between a home equity loan and a HELOC.

Closing costs are essentially the same for a HELOC and a home equity loan 2 to 5 of the total loan amount but many lenders offer to reduce or waive. Why Not Borrow from Yourself. Web Second Mortgage interest rates tend to run higher than HELOCs.

It works like a credit. Getting a second mortgage compounds these interest rates so they can run even higher than your. Contact a Loan Specialist to Get a Personalized FHA Loan Quote.

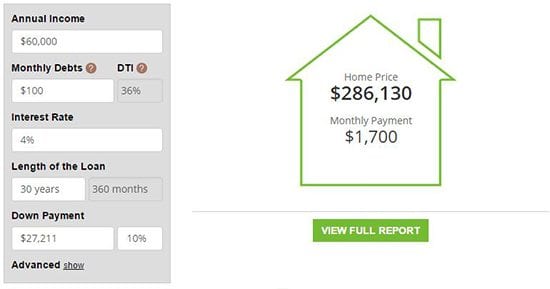

Find Out How Much You Could Be Paying Now. More Veterans Than Ever are Buying with 0 Down. Web Use Zillows affordability calculator to estimate a comfortable mortgage amount based on your current budget.

Enter details about your income down payment and monthly debts. At the outset the rate for a variable-rate HELOC may be lower than for a fixed. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Refinance Your Home Get Cash Out. Web Mortgages and home equity loans are both forms of borrowing that use your home as collateral. Skip The Bank Save.

Web Home Equity Line of Credit. If we experience a recession rates may drop a little faster. A HELOC however is not a lump sum of money.

Web To calculate home equity percentage first get the equity by subtracting the amount currently owed in mortgage loans from the current appraisal value of the home. Web Much like mortgage rates HELOC rates have been volatile recently. A HELOC is similar to a home equity loan in terms of working alongside your existing first mortgage but it acts more like a credit card with a draw.

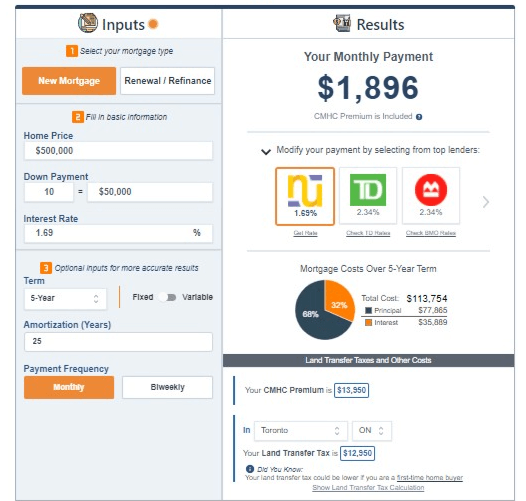

Web When that index changes the interest rate for the HELOC might go up or down. Ad Check Your FHA Mortgage Eligibility Today. Web Regarding how much you can borrow the Canadian government regulations stipulate that a HELOC combined with a mortgage cannot exceed 65 Loan to Value.

At the end of 2022 Nasdaq reported the average interest rate for a 10-year HELOC was 595. Web Use this calculator to estimate monthly home equity payments based on the amount you want rate options and other factors. Length of Loan Select One 2 Years 3 Year 5 Years 7 Years 10 Years 15 Years 20 Years 25 Years.

Learn About The Benefit of Cash Out Refinancing. Estimate Your Monthly Payment Today. Web With a home equity loan you get a lump sum.

You have two choices. Web A good rule of thumb is HELOCs often charge between 2 to 5 more than first mortgages. Web 19 hours agoAs inflation starts to come down mortgage rates will recede somewhat as well.

Web The Home equity line of credit calculator will show you an HELOC amortization schedule excel that you can view all the payments each month. Refinance Your Home Get Cash Out. Web The lender may let you borrow up to 187000 against the house minus the 100000 that you already owe on your first mortgage.

Web This calculator helps you determine your monthly payments for a mortgage loan. Home value Need help estimating your homes. Apply Get Fast Pre Approval.

Ad You Can Use the Equity in Your Home to Pay Off High Interest Debt. This is your LTV. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

In a nutshell a home equity loan is a fixed one-time lump sum that is issued. Learn About The Benefit of Cash Out Refinancing. Web A HELOC is a line of credit so you can decide how much to borrow over time while a second mortgage is a one-time loan.

By lowering your interest rate you may be able to pay off your debt more. If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Connect with a reverse mortgage lender now to see if you qualify with a free consultation.

Savings Include Low Down Payment. Todays 10 Best HELOC Mortgage Rates. A HELOC provides you a revolving credit line much like a credit card.

Ask Us Your Reverse Mortgage Questions to Decide if its the Right Option for You. Web A home equity line of credit HELOC is a type of second mortgage as is a home equity loan. The repayment period for a second.

Mortgages are used by prospective buyers to fund the purchase of a.

Continental Mtb 29 Inner Tube 29 X 1 75 2 5 Halfords Uk

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Calculator Home Equity Line Of Credit Calculator

Heloc Calculator How Much Could You Borrow Nerdwallet

43 Byfield Ln Greenwich Ct 06830 Mls 115451 Zillow

Heloc Payment Calculator Casaplorer

793 Netherlands Rd Trail Or 97541 Mls 220158988 Zillow

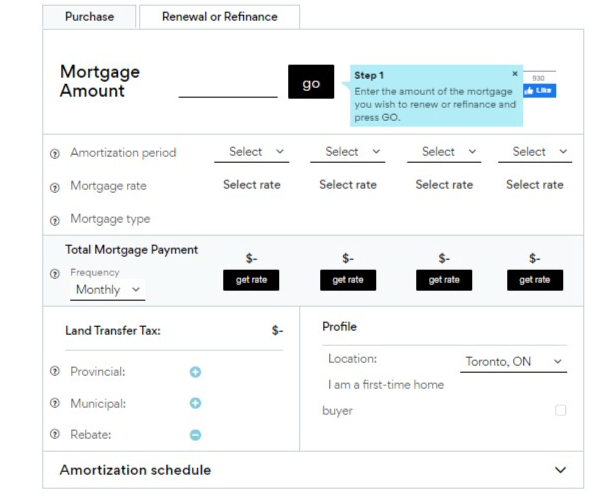

Free Mortgage Calculator Free Financial Tools Transunion

Heloc Calculator Find Out How Much You Can Borrow

![]()

Home Equity Loan Calculator Nerdwallet

5 Mortgage Calculator Features You Are Not Using But Should Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Calculator Everything You Need To Know 2023

Heloc Home Equity Loan Calculator Home Equity Line Of Credit Loans Lenders Rates

Home Equity Loan Calculator Nerdwallet

Equity Repayment Home Equity Lending Third Federal

Home Equity Loan Calculator Mls Mortgage

Second Mortgage Calculator Monthly Payment Amount Fast Mortgages